Favorite Info About How To Stop A Wage Garnishment

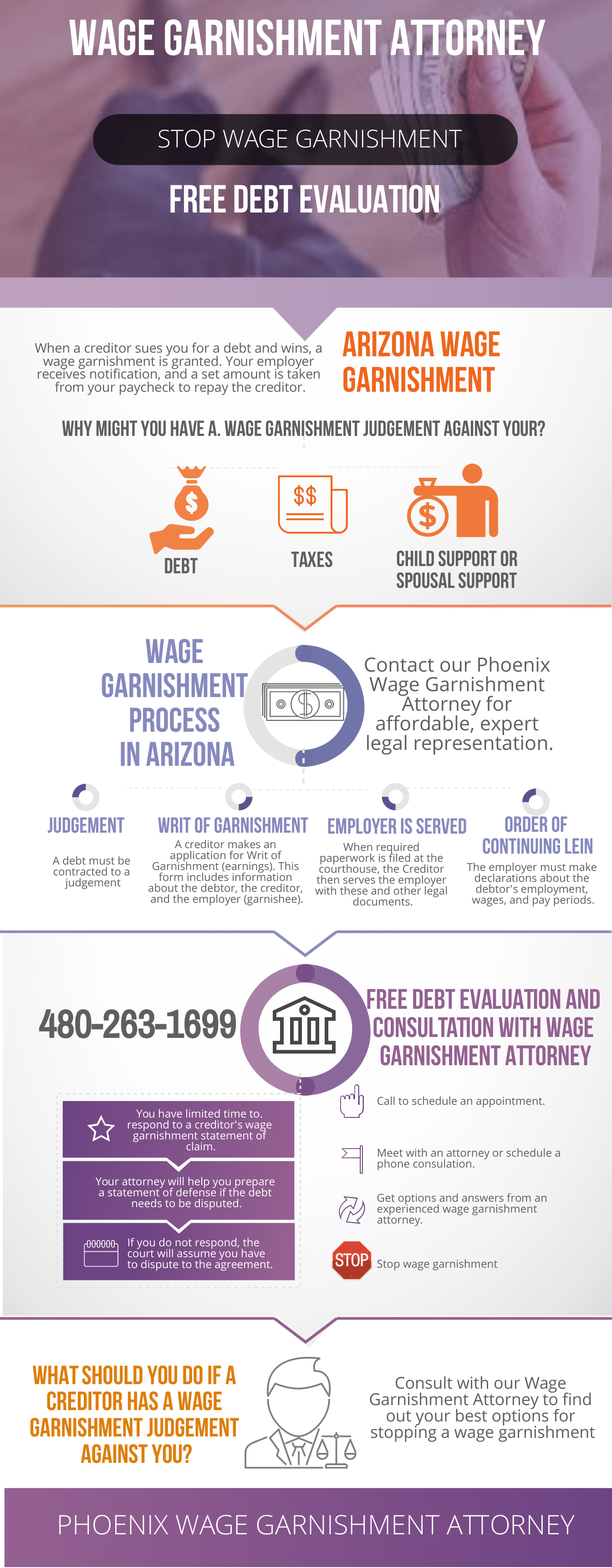

This can be a surprise and cause financial difficulty.

How to stop a wage garnishment. Inquirer los angeles / 10:40 am september 08, 2023. The loan holder is required to send a letter to the borrower at least. 3don’t ignore communications with your.

Get tips on how to. Did you know creditors can deduct your wages to pay off a debt? Your state's exemption laws determine the amount of income you'll be able to keep.

Irs wage garnishment, technically a wage levy, is part of the final step of the agency's process for collecting back taxes. Protecting yourself after you pay off a wage garnishment. You have options to challenge or limit.

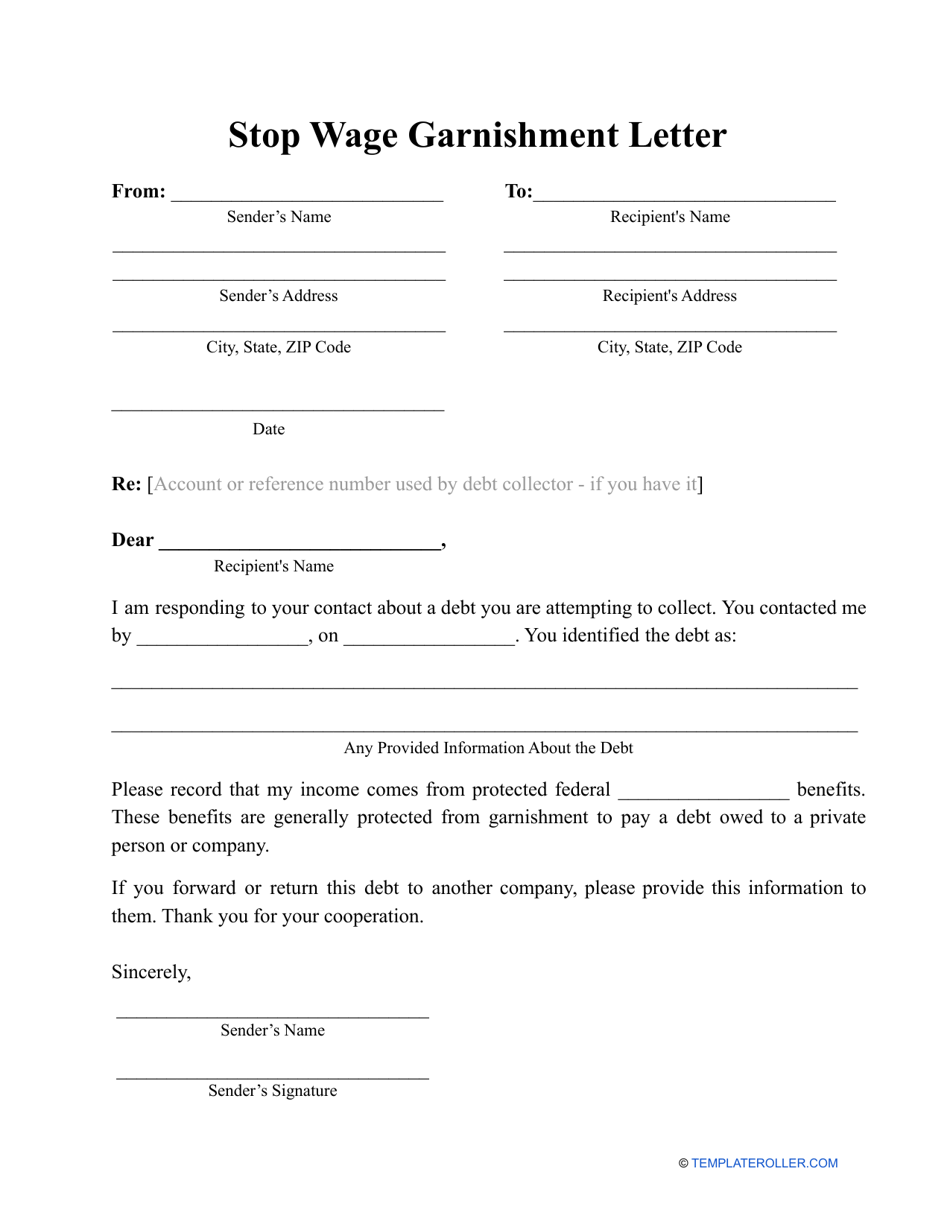

Quickly respond to a notice of wage garnishment. How to file a motion to stop wage garnishment: 2it’s easier to prevent wage garnishment.

Wage garnishment & other debt issues. Log in to studentaid.gov to view your loans. The creditor will continue to.

Table of contents. Stopping wage garnishment without bankruptcy. What is a wage garnishment and when does it happen?

Easy article navigation hide. How to stop wage garnishment: 1how does wage garnishment work?

Find out the legal steps, forms and deadlines for challenging the garnishment in your state. Irs collection process. If your employer is deducting money from your paycheck due to a wage garnishment (also called a wage attachment) and you can't afford basic living expenses, you might be able.

Learn how to object to a wage garnishment or bank levy if you can't afford to pay the debt or if you believe the judgment was made in error. Most of them rely on working with the irs to. Expert advice and effective strategies for resolving your tax issues.

Wage garnishments occur when a creditor obtains a court order to garnish the wages of a debtor for the. There are a few ways that you can avoid or stop wage garnishments once it’s started. In some situations, you can prevent a wage garnishment without.