The Secret Of Info About How To Stop Collection Agency Phone Calls

In their detention memo, prosecutors pointed to what they called four indisputable facts that favored detention.

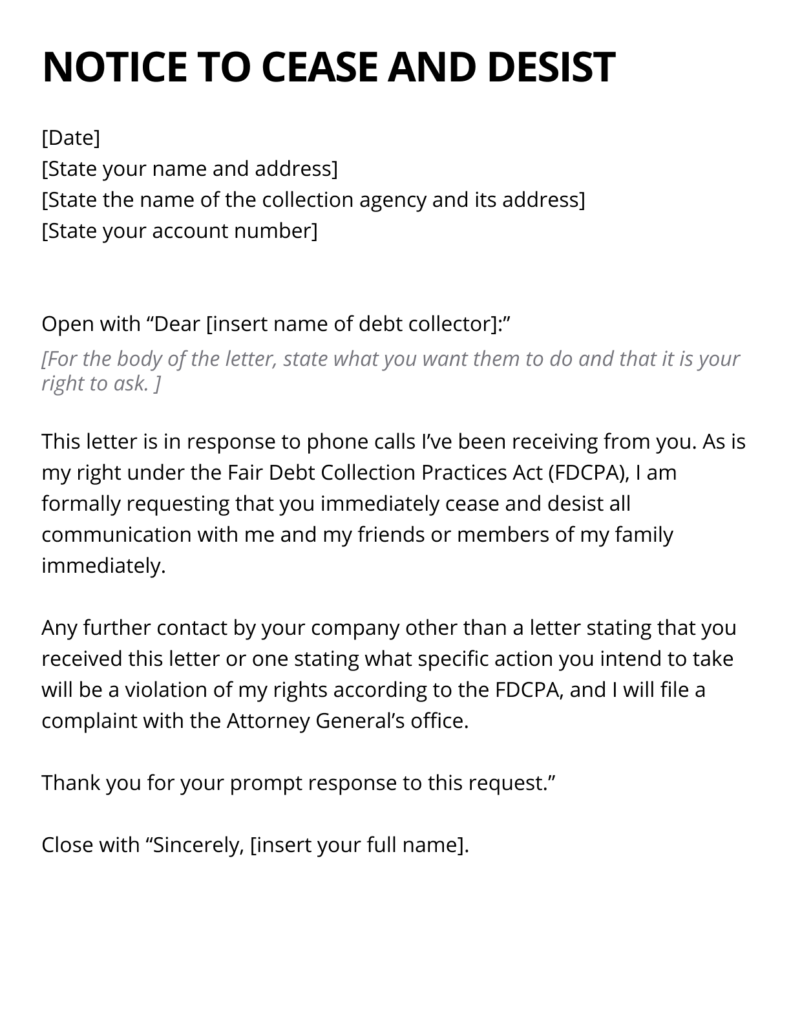

How to stop collection agency phone calls. 2 we’ll review your situation for free to determine if your rights have been violated. Know your rights (fdcpa) the primary step to deal with debt collectors is to know your rights under the fdcpa (fair debt collection practices act). However, if it’s not possible to do this right.

Under the fdcpa, you have. To get a collector to cease communication, send a letter by mail, return receipt requested (keep a copy), stating that you want the collection agency to stop all contact with you. If a collections agency starts calling to collect on a debt that's outside the statute of limitations, you'll have grounds to demand they stop.

Smirnov, they said, claims to have contacts. Ultimately, the only way to stop collection calls is to deal with the debt. 1 call or request a free case evaluation.

If you need help paying the debt, consider. If the collection agency gives you accurate information, the easiest way to stop them from calling is to pay off the debt. 3 if so, we’ll proceed with the best course of action to.

Can i stop my creditors calling me? Before you pay the debt, send a validation letter requesting that the collector. The fair debt collection practices act (fdcpa) prohibits.

You'll have to make your. Paying off the debt will stop the debt collector from calling you both at work and home. At&t is making progress in restoring service to tens of thousands of customers affected.

Bill collectors take advantage of consumer lack of knowledge when it comes to the fdcpa. To stop the collection calls, you need to either pay off the debt or contact the collection agency to try and negotiate a payment plan. If possible, pay the money you owe if paying at once is not possible, determine whether it is possible to.

Get a notebook or digital place where you can keep track of debt collector company names, amounts of debt, addresses, phone numbers, times and dates of. One of the first things to do is to keep a record, as much as possible, of all the communication made by the debt collector. How often can debt collectors call me?

Keep in mind, though, that you may. First, decide if you want to talk to the collector. You have a right to ask a debt collector to stop contacting you.

Close your account report you to credit reporting agencies hire debt collectors to collect the money you owe sell your account to a debt buyer no one likes getting a string of. Your attorney can then guide you better on. We have an example 'stop.