Exemplary Tips About How To Manage Payroll

There are a wide variety of reliable applications to choose from.

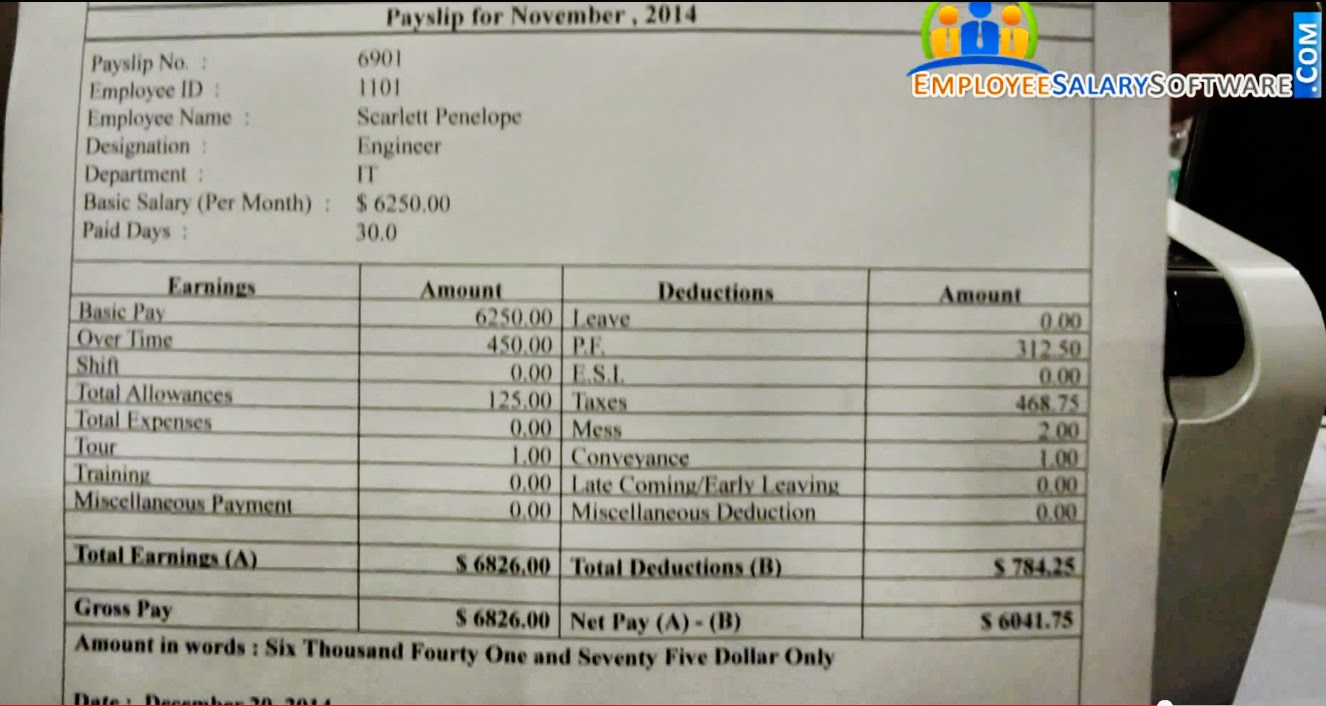

How to manage payroll. Get personalized recommendations, and learn where to watch across hundreds of streaming providers. 6 steps on how to manage payroll? Use this guide to help you understand what's involved and how to run a smooth payroll process.

Secondly, you also need to make sure you calculate the right rate of tax for each employee. When you onboard a new employee, there’s a standard set of documents that you need to collect: Find ratings and reviews for the newest movie and tv shows.

That’s why it’s important that businesses learn how to manage payroll effectively, as it directly affects their financial health. Create a payroll management checklist. To manage payroll and hr for a remote workforce, employers must establish clear communication channels, utilize technology solutions for time tracking and payroll processing, implement remote performance management systems, and provide ongoing employee support.

Frequently asked questions (faqs) every business with employees has to process payroll. How to manage payroll for a small business | netsuite. With employees comes payroll, an essential and complex task.

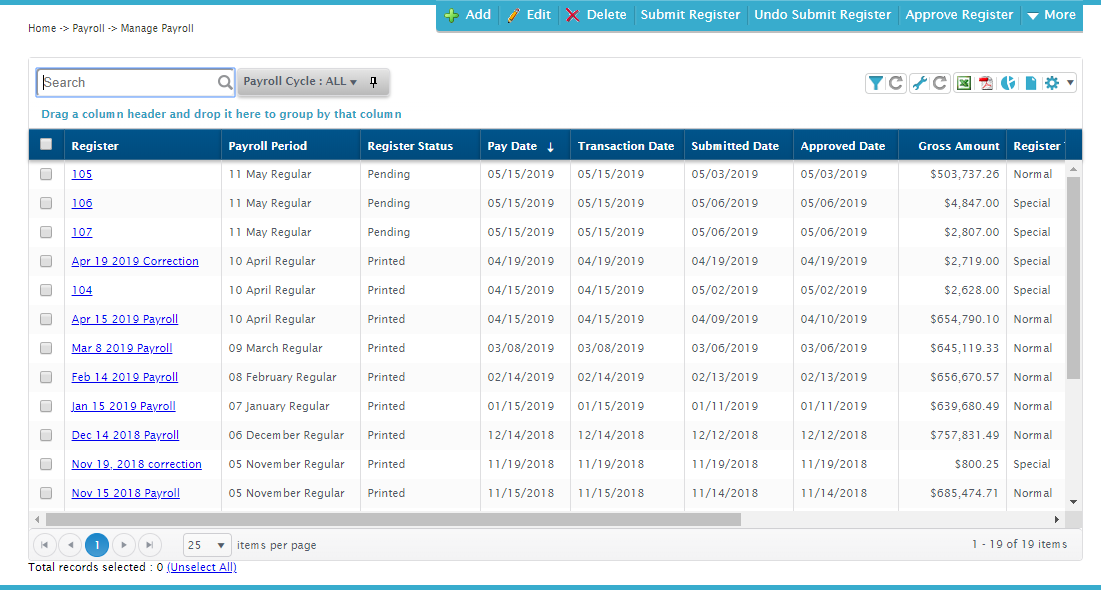

Using a payroll management checklist can help you keep track of tasks and ensure that you complete each one. Here are some of the main duties for managing payroll. As a business owner, you will need to obtain an employer identification number (ein) in order to file the necessary forms for managing payroll.

Your small business is up and running, and you’re ready to start hiring employees. These systems provide a template and you input the details and input factors for each employee. Regardless of how an employer chooses to manage payroll, there are several basic steps that apply to most methods:

First and foremost, your company needs to obtain an employer identification number (ein). Payroll is a highly important instrument in ensuring a business grows efficiently and consistently. Learn why payroll management is important and how.

It’s also about avoiding costly mistakes. How to manage payroll. Payroll errors can be the downfall of a company, causing legal issues and upsetting employees.

How to do payroll in 8 steps. If payroll processes are disorganized, errors may be made. According to research, over 50% of the u.s.

Payroll is a continuous process with many moving parts, including paying taxes and verifying that records are current. 15 payroll tips and tricks for businesses. One of the main reasons it’s important to manage payroll — and to do so correctly — is compliance with local, state, and federal laws.