Perfect Tips About How To Claim Travel Expenses

Jones, ea, jd updated august 18, 2023 you don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions.

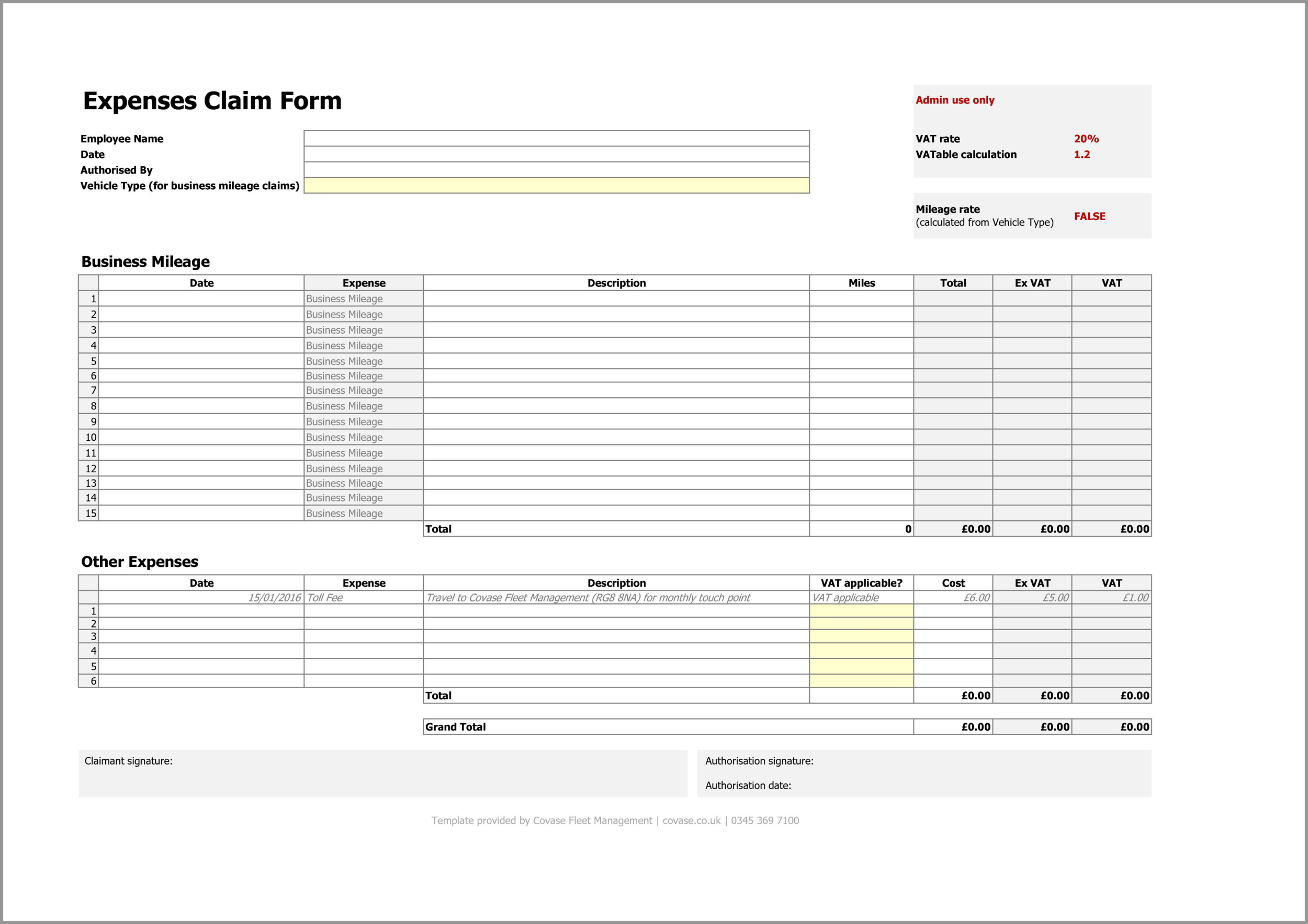

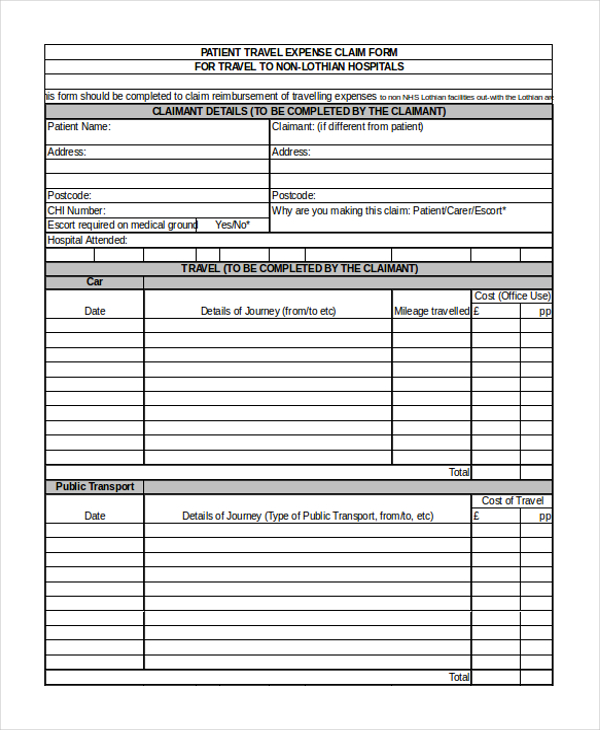

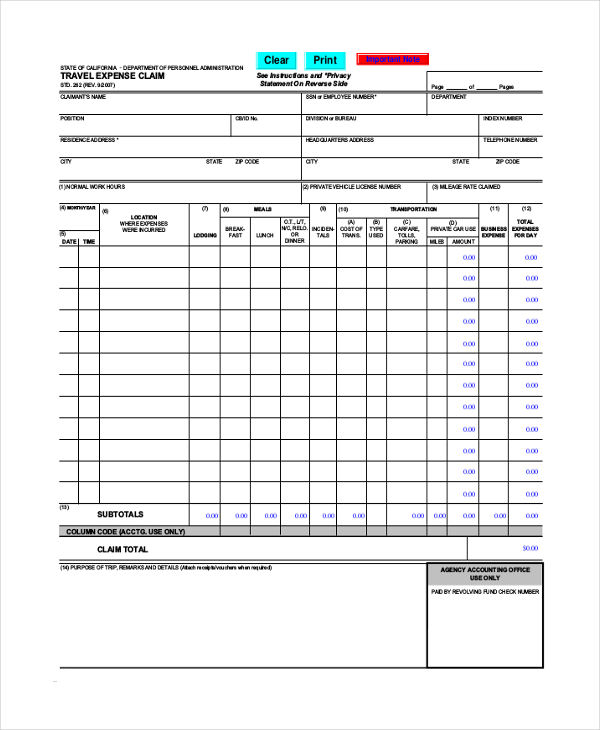

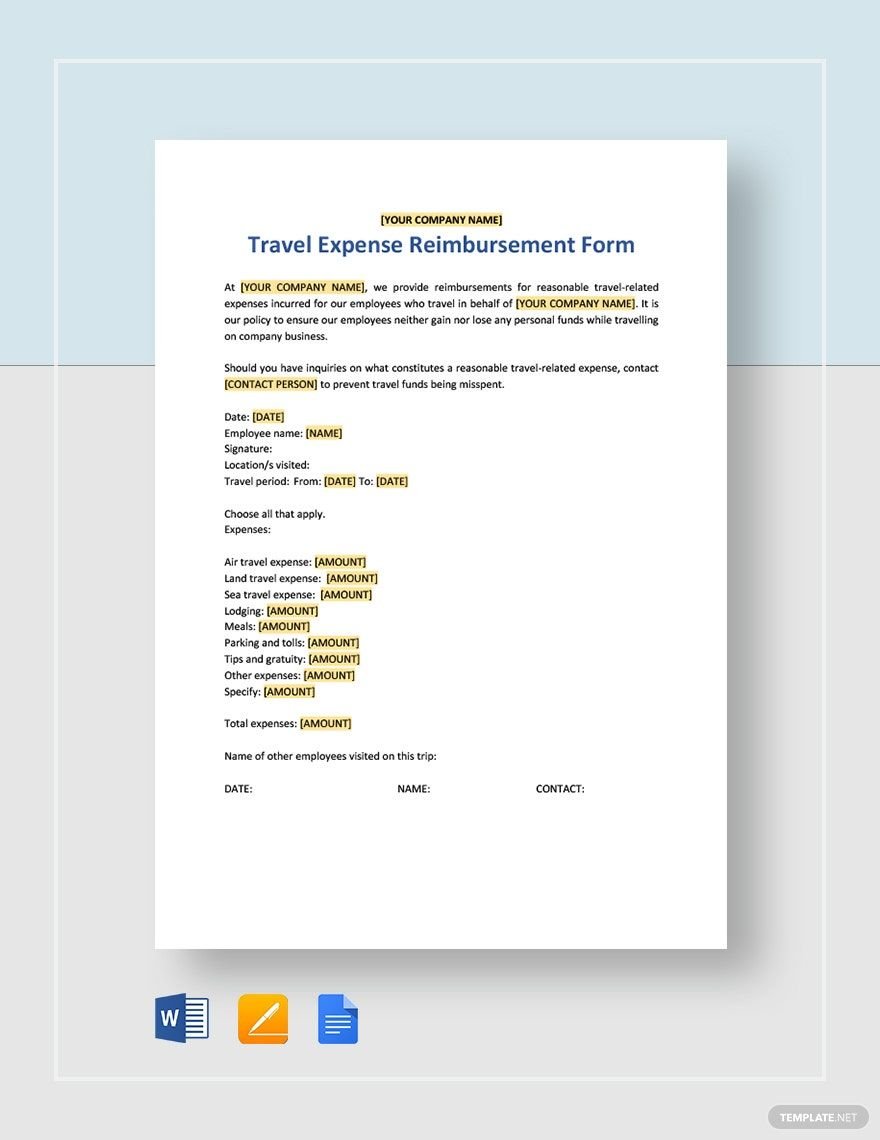

How to claim travel expenses. Taxpayers can deduct medical expenses by itemizing them on their taxes. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. In this case, they are expenses incurred whilst travelling for business purposes.

Anything beyond that is 25p. How much can i claim? Tell employees to pay using their own month and claim back the expenses later.

When it comes to business travel, understanding what exactly qualifies as a travel expense under hmrc guidelines is crucial for businesses in the uk. When it comes to business travel, the more you can automate your expenses, the better. Since the line between business and nonbusiness travel is hard to draw, you can take a few steps to ensure your trips' overhead costs qualify.

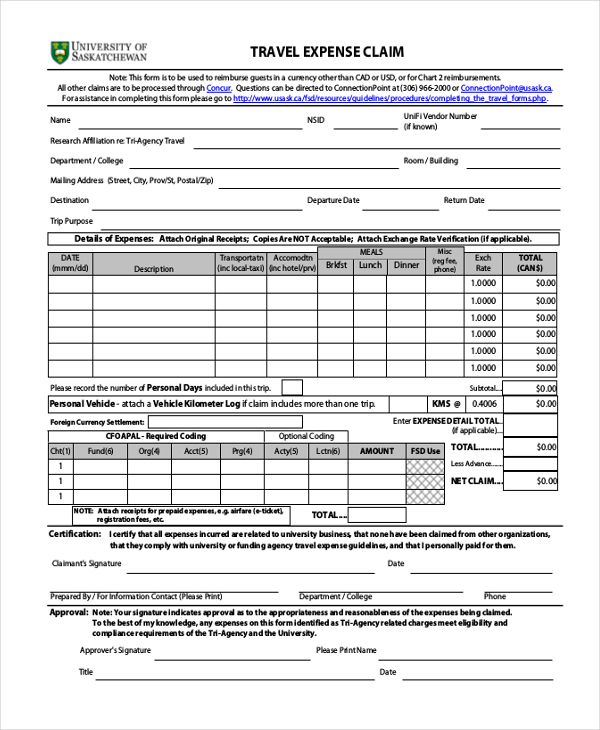

Make sure you have food receipts, taxi/train/bus bills, along with hotel bills. 58.5 cents per mile from jan. Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

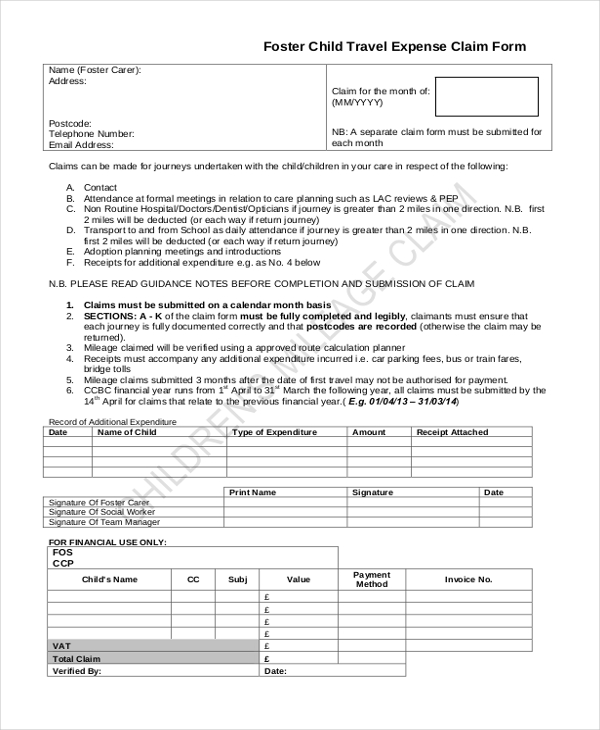

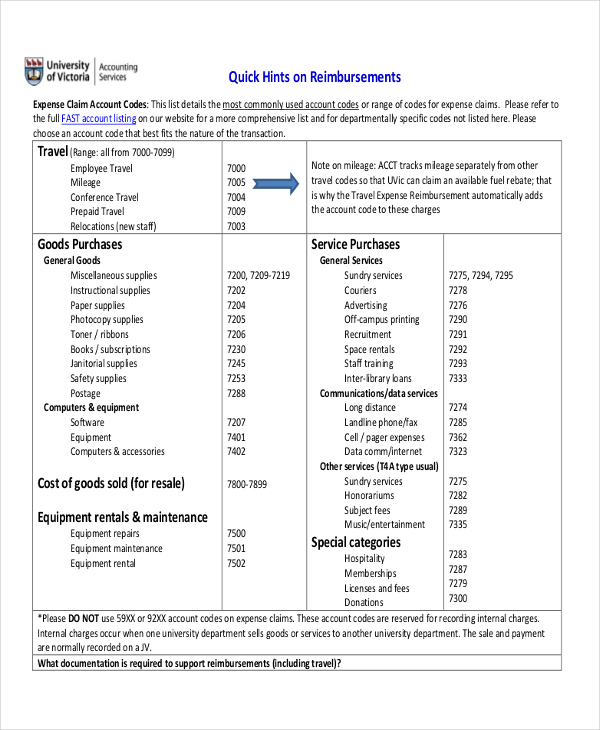

Print or download on this page expenses you can claim expenses you can't claim how to claim employee travel expenses travel diaries records for business travel expenses as a business owner, the general rule is that you can claim deductions for expenses if you or your employee are travelling for business purposes. The irs allows tax deductions on certain travel expenses when the trip's main purpose directly relates to your business. Including the ptss guideline, frequently asked questions, eligible specialist services, the appeals process and providing feedback.

You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home). Give each employee a daily allowance to cover meals. Hei is still figuring out funding sources for fund 2.

7, the day before the fires. For instance, if your home is 1,800. Check if you can claim;

Key takeaways what are travel expenses? The principal of one of scotland's biggest colleges has charged more than £100,000 in expenses over the last 10 years, including more than £13,000 at a private members' club in london. Airfare, train, bus tickets, and even car or van.

Broadly, hmrc defines travel expenses as costs incurred while employees are travelling for work purposes. If you're a member of the national guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. For the 2022 tax year, the irs approved the following standard mileage rates:

Filing and processing every single expense claim by hand is a huge productivity killer. To find the percentage, compare the size of space you use for business to that of your entire home, and then apply the percentage to the specific expenses.