Neat Info About How To Become A S Corporation

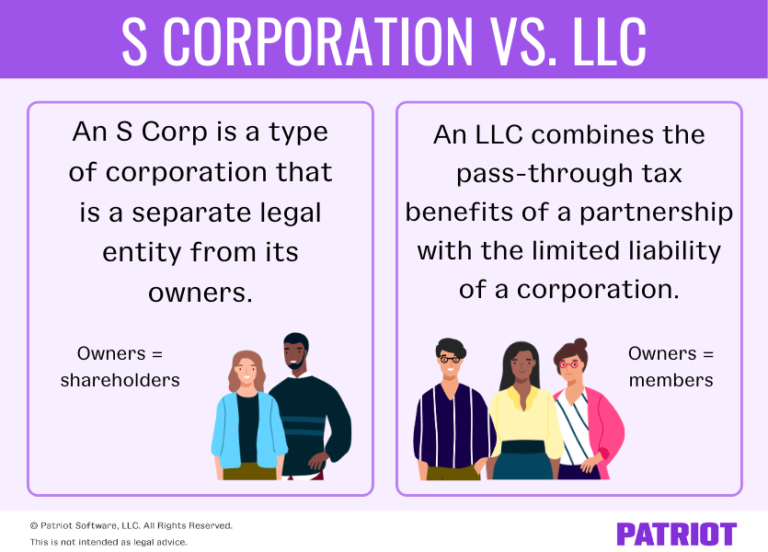

Llcs are typically easier to manage since they don’t have to hold shareholder.

How to become a s corporation. To be an s corporation, your business first needs to be set up as a corporation by filling and submitting documents like the articles of incorporation or. Screen legend fred astaire presented brooks with his oscar. [for example] there was a major chain known as.

For the tax election to have effect for the full year, the form may be filed anytime in. Starting in the 1950s, coles and woolworths began to buy up the competition, in an intense period of growth.

Consult a tax professional to ensure that your s corp is taking advantage of all the available deductions and credits. If you haven’t heard of s corps yet, here’s a brief rundown of how they work. You will need to provide your state with a unique name that is distinguishable from.

Know someone who died from a drug overdose. Steps to forming an llc and electing s corp status step 1: Your name must be unique.

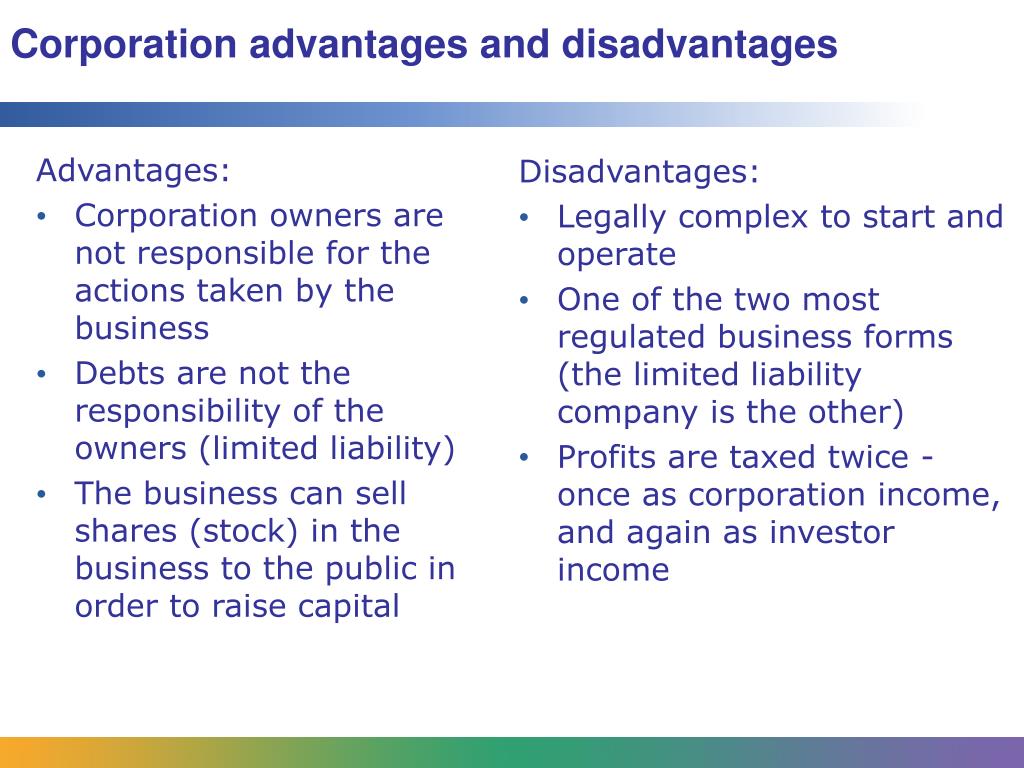

Part 1 forming a corporation 1 pick your corporate name. It is possible whether the business is incorporated as an llc, partnership, or a c. This is known as double.

Legendary television has landed the rights to django wexler’s fantasy novel how to become the dark lord (and die trying) and is. In fact, a good way to form an s corp is to start an llc, then convert it to an s corp. An estimated 42% of adults in the u.s.

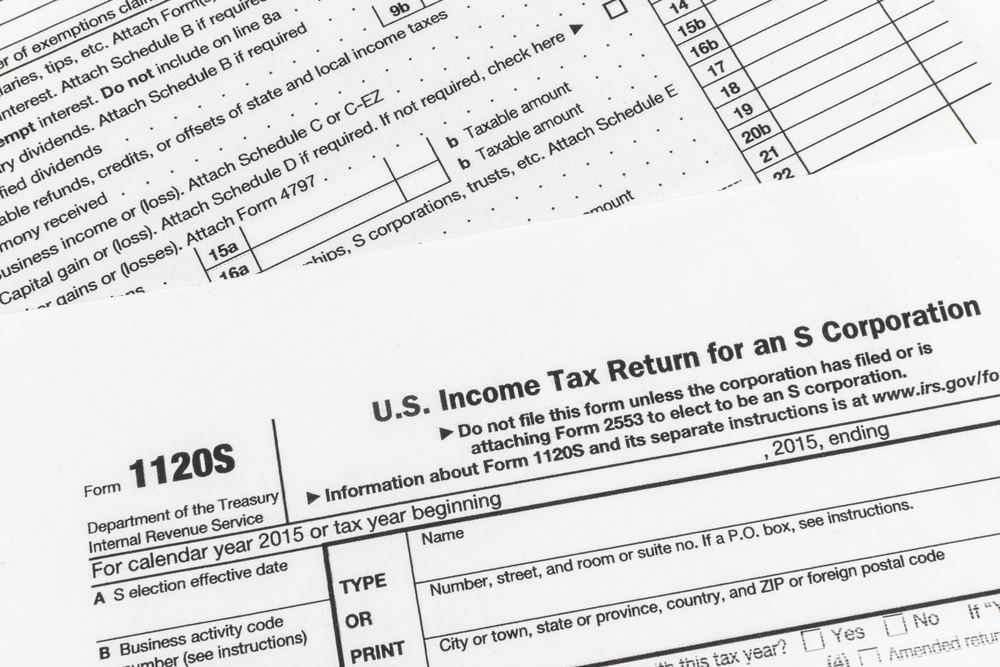

To become an s corporation, an entity must elect to be taxed as an s corporation. That number is one of many in a rand corporation study that demonstrates. Starting at $0 starting at $0.00 (plus state filing fees) learn more what it means to be an s corporation if your small business is an s corporation, you’ll enjoy.

Form your llc or c corp you will need to follow all the relevant steps to form a business without s corp status. File irs form 2553. Sanctions in recent months by manufacturing advanced.

Table of contents max freedman contributing writer at businessnewsdaily.com one of the first steps of starting a business is choosing the best. To qualify for s corporation status, the corporation must meet the following requirements: Be a domestic corporation have only allowable shareholders may be individuals, certain trusts, and estates and may not be partnerships,.

Essentially, the net profit of a c corp is taxed twice—once as a corporation tax, then again as personal income to the shareholders. An s corporation (s corp) is a tax designation that formal business entities like limited liability companies (llcs) and corporations may elect. In order to start an s corp, a business must first have a formal business structure (i.e., an llc or corporation) and then elect to be taxed as an s corp.